![]()

Lending Tech: The Continued Disruption in Consumer Lending Markets

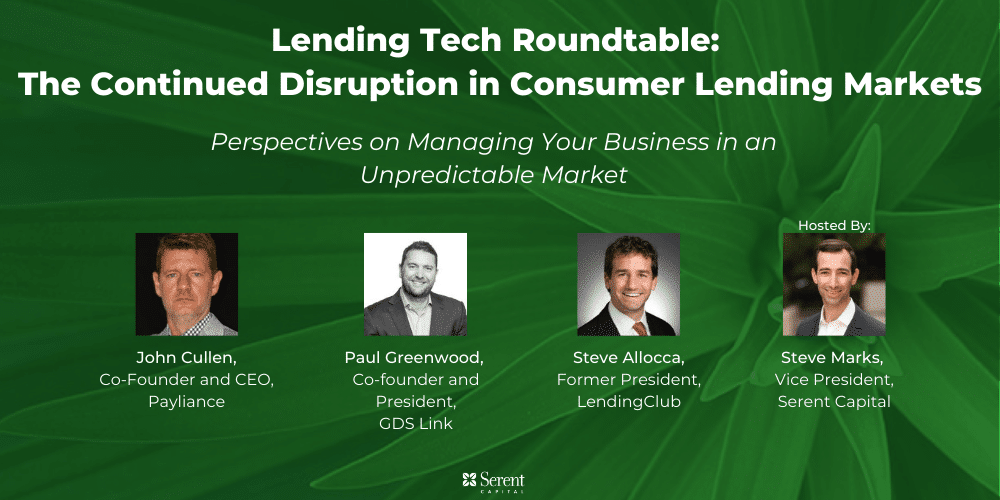

Serent Capital recently brought together three leaders in the lending tech industry for a roundtable discussion on the ways consumer lending markets are changing in a post-COVID world. Moderated by Steve Marks, Vice President at Serent Capital, the participants included:

- John Cullen, CEO of Payliance, a leading provider of payment processing and risk management solutions

- Paul Greenwood, Co-Founder and President of GDS Link, a global leader in credit risk management

- Steve Allocca, former President of Lending Club

The pandemic has had dramatic effects across the entire economy, and the lending tech sector is no exception. Our conversation focused on understanding the current state of the lending market, specifically highlighting how federal assistance programs, changes in the job market, and unexpected consumer behaviors have all impacted consumer lending. Our goal was to share our perspectives and identify the major opportunities and challenges for lending tech providers as we continue to navigate COVID and its aftermath.

Our discussion focused on the following topics:

- How consumer lending has changed during COVID

- How federal stimulus has impacted borrowers and the lending market

- How loan repayment activity has changed

- How the changing employment landscape has impacted the lending market

- How long-term low-interest rates are changing the lending market

- Changes in borrower behavior during COVID

- Investing for the future in a time of such high uncertainty

- Opportunities and growth areas in the lending tech industry

How consumer lending has changed during COVID

- Consumers are using stimulus funds to save and pay down debt. Volume in most consumer lending categories has been much lower this year than would be expected during a normal recession, Greenwood observes. “With the stimulus checks being given out, there’s definitely been a reduction in loan volume as a lot of the payday borrowers have actually paid off their payday loans. And second to that, there has definitely been a stockpiling of cash with the borrowers. So, it’s definitely been a lot different this time around.”

How the stimulus has impacted borrowers and lending markets

- Borrowers are tightening credit criteria. Greenwood says, “A lot of lenders are really taking extra steps in the origination and underwriting process to do a lot more check-ins and make sure that the borrower is still employed: asking for recent paychecks, using services like Plaid to go in and make sure that the borrower can really afford to pay the loan that they’re asking for. Borrowers are definitely tightening their credit criteria and that’s trickling all the way down to loan volumes as well”.

- Although some lenders are already starting to evaluate loosening again given strong credit performance. “As payment performance continues to be unlike anything we’ve seen in any sort of a downturn, I think you’re already seeing some signs that the continued tightening of underwriting is beginning to change course as well,” Allocca observes.

- In most consumer lending categories, volume is down considerably…

- Both traditional lenders and newer FinTech lenders are seeing loan volumes down considerably from pre-March 2020 levels

- … but some verticals have seen increased borrowing activity

- Low interest rates have driven an increased number of home loans

- With more consumers watching their money carefully and a number of factories shut down during COVID, used auto loans have increased significantly

- “Buy now, pay later” markets that enabled consumers to break down large purchases into a number of payments

- Point-of-sale financing for large purchases such as construction or remodeling purchases has also seen a surge as well

How loan repayment activity has changed

- Expected increases in demand for credit have not materialized. In the early days of the pandemic, lenders expected a massive increase in consumer demand for credit — and a steep increase in default. But as Cullen notes, that’s not what happened. “Because of the structure of the stimulus, you saw something that’s really unusual. In a world with really high unemployment rates, you also have FICO scores improving to the point where they’re the best they’ve been in 15 years, and consumers building the asset side of their personal balance sheet. And so lenders really didn’t have a liquidity problem. They were flush with cash.”

- In the subprime sector, loan volumes were down 60% to 70% in spring 2020, but lending volume has started to bounce back and is now down about 30%

How the changing employment landscape has impacted lending

- Traditional measures of creditworthiness aren’t working anymore. “The obvious question in everybody’s mind is, are the typical ways that we assess creditworthiness — and particularly ability to pay, of which employment is an important part — are they accurately reflecting reality?” Allocca asks. “In everybody’s gut who’s been around lending for any period of time, the answer is undoubtedly no. FICO scores are at an all-time high, but consumers do not have an all-time high ability to repay. You have to rely more on non-traditional, non-bureau data like cashflow data that gives you a better, real- time indication of a borrower’s capacity to repay.”

- Alternative data sources give lenders a more accurate picture. With FICO scores no longer reliably predicting ability to pay, Paul Greenwood notes that lenders have turned to other measures. “One of the issues that we’re facing is the accuracy of the data in the credit report. We’ve seen these flags come through on credit reports, but there’s no way to really tell whether they’re 30 days past due or 90 or 120. That’s definitely been a challenge. We’ve used alternative data like bank transaction data which gives the lender a real-time view on the borrower’s cash flow. Data just gives them a lot better insight on the borrower’s potential ability to pay and how they’ve been impacted.”

How low interest rates are changing the lending market

- Consumers will continue to deleverage. “Consumers have deleveraged after every recession,” Allocca observes. “Coming out of what is certainly going to be a prolonged economic event, it’s hard for me to believe that there won’t be a continued trend towards deleveraging and just trying to balance that with consumers’ need to be able to make ends meet as the stimulus runs out.”

- Lenders are making more money from fees. While many lenders are struggling to attract new borrowers, Greenwood notes that “banks are actually making more money on fees. So that’s how they’re managing to move forward and continue with growth.”

- Banks are facing multiple challenges. The current landscape has been challenging for traditional banks, Cullen notes. “A lot of the big banks are in the card issuing business. That’s facing pressure from buy now, pay later. And there are the LendingClubs of the world as well. Banks are trying to get on the front foot, as an example, in the small-dollar lending world. Bank of America, US Bank, and Fifth Third Bank have all announced products in that space, but it’s still TBD whether they can be successful there.”

- Challenger banks are starting to offer credit products. “In the U.S., challenger banks are using a debit card interchange-based revenue model. And the growth of some of these companies is tremendous,” says Allocca. “The mobile first experience, being more customer centric, the positioning of being a better bank — all of that is clearly resonating with consumers. Already, you’re starting to see some of them move into overdraft protection or some form of early credit. And they’re going to have to be on the leading edge providing credit products to have a more sustainable business model. I think that’s why you’re seeing a lot of the challenger banks already starting to move in that direction.”

Changes in borrower behavior during COVID

- Lenders are preparing for delinquencies. So far, lenders have been shielded from delinquencies by federal stimulus programs, Paul Greenwood notes. “At some point, that’s going to run out. Lenders are starting to take action to make sure that they’re looking at the default models as well as collection models, making sure that the models are up to date. Lenders are definitely taking a lot of steps to mitigate what they know is coming and to reach out for borrowers that they can see are going to need some help in the future.”

Investing for the future in a time of high uncertainty

- Preparing for regulatory changes. The potential for a new administration is just one of the challenges the financial services industry is facing going into 2021, Cullen predicts. “In a Biden administration, we’re likely to have some regulatory headwinds. I think that’s across a lot of fronts, not just financial services, not just FinTech. You’ll hear a lot more energy, particularly if the Senate turns as well, around legislative change. From our perspective, we see that as an opportunity to help our lenders more. When they have those headwinds, there’s opportunity to lean in and take advantage of the change in a way to help them pivot more quickly, and perform well, in that kind of environment.”

- The +36% industry has historically been able to pivot and survive in the face of challenges from the CFPB and other regulatory agencies

Opportunities in the lending tech industry

- Helping smaller and regional institutions build out their digital offerings. Greenwood observes: “Most customers these days expect to be able to transact across the entire set of bank products online, whether it’s mobile or just with a browser. There are less and less people that want to go into branches. That was a generational shift that was already starting to happen, but with COVID, it’s really starting to accelerate.”

- Analytics offer a tremendous opportunity to stay on top of market trends. “Analytics is just such an important aspect of being able to model various outcomes and then monitor them in real time,” Greenwood says. “So, we’ve seen a big shift into really advanced analytics to help with that — not just using credit data, but using all the different data that’s now available in the marketplace.”

- Opportunities to leverage analytics in the lending space

- Taking advantage of bank transaction data to create sophisticated models for every aspect of the lending process

- Identifying additional data about how, when, and from where your customers are interacting with you

- Collection support will become important during recovery. “I think we all believe there’s a credit cliff coming,” Cullen adds. “And while some part of the consumer base has been saving, not every part of the consumer population will have managed that. It’s likely that lenders will need support on the collection front when the stimulus subsides and the temporary benefits go away.”

- Opportunities to leverage analytics in the lending space

Coming trends in the lending tech industry

- Strong interest in innovative products will continue to power the lending tech market. Greenwood sees enormous ongoing opportunity in the FinTech space. “There’s a lot of new FinTech providers that are coming into the market. We see them all the time,” he observes. “The good news is that a lot of lenders want to try out these new products. They’re definitely looking for new ways to keep the cost of originations low. They’re willing to try new data sources, new fraud algorithms. As long as these FinTechs can demonstrate ROI, lenders are always willing to try new products.”

- Regulatory changes offer an opportunity to provide better customer support. While regulatory changes may be coming, Cullen advises you to use them to your benefit. “If you can use that as an opportunity to help your customers more, I think you’re going to have the right mindset to take advantage of change,” Cullen notes. “And, really, one of the largest advantages you’ve got is your ability to be nimble. You have to leverage that competitive advantage against other larger competitors that have a tougher time shifting quickly.”

- Increasing digitization will lead to more useful consumer data. “It’s stating the obvious, but one of the productive things that’s going to come out of COVID is accelerating our usage of our devices,” Allocca observes. “The more customers choose to interact in ways that are digital, the more ability we have to be able to paint a perfectly vivid picture of their current (and likely future) financial condition. If I interact with you via a chatbot in my service, I’m providing you with data that you will never be able to capture in a traditional phone-based interaction. To me, that’s the exciting opportunity that will come out of this disruptive period called COVID.”

With enormous changes happening across the financial services industry, there’s never been a better time for lenders to better serve their customers with innovative, data-driven solutions. Here at Serent, we’re excited about supporting consumers in achieving long-term financial health with solutions that redefine what’s possible in the lending industry.